From Senior to Subordinated: A Deep Dive into the iTraxx LevX Indexes

Nov 23, 2024 By Pamela Andrew

Credit derivative financial markets have some excellent qualities and come as indexes of iTraxx LevX, especially while trading credit derivatives. Since their establishment in 2006, these indexes have helped investors, together with other financial institutions, monitor the leveraged loan market with insightful investment opportunities. Compared to other financial instruments, iTraxx LevX indexes track specific credit default swaps CDS of high-debt European companies.

In this paper, the workings of the iTraxx LevX indexes, along with their structure and importance, will be presented in clear form regarding their applications in today's financial landscapes. So, without any further ado, lets begin exploring!

What are the iTraxx LevX Indexes?

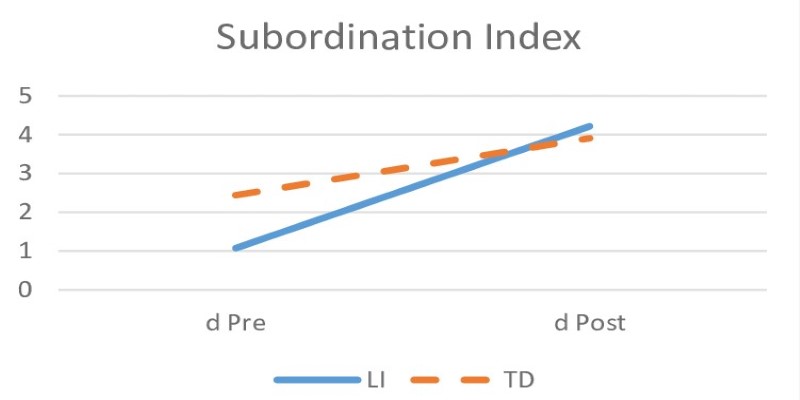

The iTraxx credit derivative indexes include specialized indexes for different global markets, which are divided into three categories: Europe, Asia, and Australia. LevX Senior Index represents senior debt, and the LevX Subordinated Index deals with subordinated debt; it can be a second or third lien. Each of these indexes contains credit default swaps that refer to a basket of companies with leveraged loan structures from Europe. Most companies have large debt and more credit risks and therefore credit rating.

The LevX indexes differ fundamentally from the other iTraxx indexes, which normally represent investment-grade corporate debt. Since leveraged loans carry a greater risk of default, their borrowers tend to receive a higher interest rate for such loans, which in turn gives rise to a natural demand for CDS protection among investors interested in hedging potential losses. This structure allows the iTraxx LevX indexes to better reflect the underlying risks and rewards.

How do the iTraxx LevX Indexes Work?

The LevX indexes consist of credit default swaps, financial derivatives that transfer credit exposure between two parties. When investors buy a position in either the LevX Senior or Subordinated index, they are effectively buying CDS on an aggregate portfolio of leveraged loans. Each CDS contract has a reference obligation tied to specific European companies with high debt profiles.

The two LevX indexes have five-year maturity and introduce new series every six months in March and September to make sure the indexes reflect the most liquid loans and the current market situation. This allows the biannual "roll" process for indexes, capturing companies or loans that might have changed creditworthiness or liquidity status.

Major banks include Morgan Stanley, Barclays, and UBS, forming a consortium to set and monitor the prices of the LevX indexes with transparent prices and liquidity. They update the prices twice a day, at mid-day and the end of the trading day. This assists the investor in real-time knowledge of market conditions.

Applications of iTraxx LevX Indexes in Financial Markets

The iTraxx LevX indexes are vital tools in financial markets since they can be used to hedge and speculate. For instance, large financial organizations such as banks use the indexes to mitigate the credit risk associated with the leveraged loans on their balance sheet.

A financial institution can eliminate potential losses on risky debt investments by holding positions in either LevX Senior or Subordinated indexes. This hedging functionality enables them to hedge against the risk of defaults on their larger portfolios of debt, decreasing their overall chances of being exposed to defaults in a volatile credit market.

For the speculators, the LevX indexes present them with an opportunity to make money off credit quality changes in highly leveraged European companies. During economic uncertainties, investors can purchase protection through these indexes, thereby preparing themselves to receive settlements when defaults increase.

During an economic upswing, however, they can "sell" credit protection to take advantage of a decreasing risk of default and thus reap gains as the credit conditions improve. The LevX indexes, therefore, play a dual role because they are both a hedge to shore up defenses in adverse markets and a vehicle for profit in market fluctuations.

Demand and Liquidity in Markets

Since their inception, the iTraxx LevX indexes have carved out a niche in high-risk, high-yield financial products, attracting institutional interest but with variable trade volumes. The growing demand for derivatives focused on leveraged loans and sub-investment grade debt has driven demand for the LevX indexes as tools for managing risk and investment.

Indexes are actively traded by hedge funds, asset managers, and investment banks. These are mostly traded over the counter rather than in traditional exchanges. It would give much-needed flexibility and customization to investors looking for a way to tailor risk exposure.

Average traded dollar volumes in LevX indexes are lower compared with broader market indexes. However, the average traded dollar amount has grown as institutions leverage these indexes to manage leveraged debt exposures. Price setting is, therefore provided by pool large banks like Morgan Stanley and Barclays for transparency while indexing the representation of liquid debts issued in the market.

Of course, such transparencies notwithstanding, LevX specializes in more relatively lower-rated debt whereby index values exhibit higher volatility for responsiveness to the changes in credit more than an investment-gradable asset in indexes does. This sensitivity is a draw to the attractions of these indexes to an investor who might be searching for specific risk appetites while, at the same time, showing volatility.

Conclusion

iTraxx LevX indexes are credit derivatives that focus only on leveraged loans and risky European debt. It serves as a good tool for tracking senior and subordinated debt for risk management or speculative opportunities. These indexes may be volatile, but they give real-time insight into the leveraged loan market in Europe and can help institutions gain credit exposure without holding risky assets directly.

Hence, with the changing face of the global economy, LevX indexes remain very important tools for hedging against credit risks and capturing high-yield opportunities, which are crucial tools in navigating complex credit markets in Europe today.